I

love this one. I love it like the Mooch loves Trump. God, I hope there's something to it.

Third party candidate Jill Stein was a surprising addition

this week to investigators casting an increasingly wide net in the

congressional probe into Russian interference in the presidential campaign.

Stein’s name was included in a Senate Judiciary Committee

letter requesting all communication between President Trump’s son Donald Trump Jr. and a

number of others, including Russian officials and other members of Trump’s

presidential campaign.

Yeah, it's a smear and McCarthyism and blargh! Hope not.

I'd be more than willing to

give her a pass on this if it wasn't for Matt Funiciello. That and the general holier than thouness of the Green Party.

She has made purity a central pillar of her presidential

candidacy, and she has held that the Green Party reigns above all others with

respect to moral and ethical supremacy. In an interview with CNN last April, she said, “I have long

since thrown in the towel on the Democratic and Republican parties because they

are really a front group for the 1 percent, for predatory banks, fossil-fuel

giants, and war profiteers.”

Yes, that's what I'm talking about. She's invested in mutual funds that invest in companies that include predatory banks, fossil-fuel giants and war profiteers. Not directly invested. But you know what, she doesn't deserve a break for it anyway.

Stein has invested $995,011 to $2.2 million in funds such as

the Vanguard 500 fund that maintain significant stakes in Exxon and other

energy companies like Chevron, Duke Energy, Conoco Phillips, and Toho Gas, a

Japanese company that engages in the sale of natural gas, tar, and coke, a fuel

made from coal.

...

Stein has invested roughly $1.2 to $2.65 million in funds

like the TIAA-CREF Equity Index that have big stakes in the financial-services

industry. Holdings in these funds include big banks like JP Morgan Chase,

Citigroup, and Deutsche Bank as major parts of their investment portfolios.

Five of the funds that Stein invests in maintain large positions in Wells

Fargo, which has come under fire recently amid charges that its employees were

pressured to open up fraudulent new accounts for clients.

One of the funds Stein has invested in maintains a

significant position in Goldman Sachs bonds. Stein once referred to Goldman

Sachs as Hillary Clinton’s best friend.

…

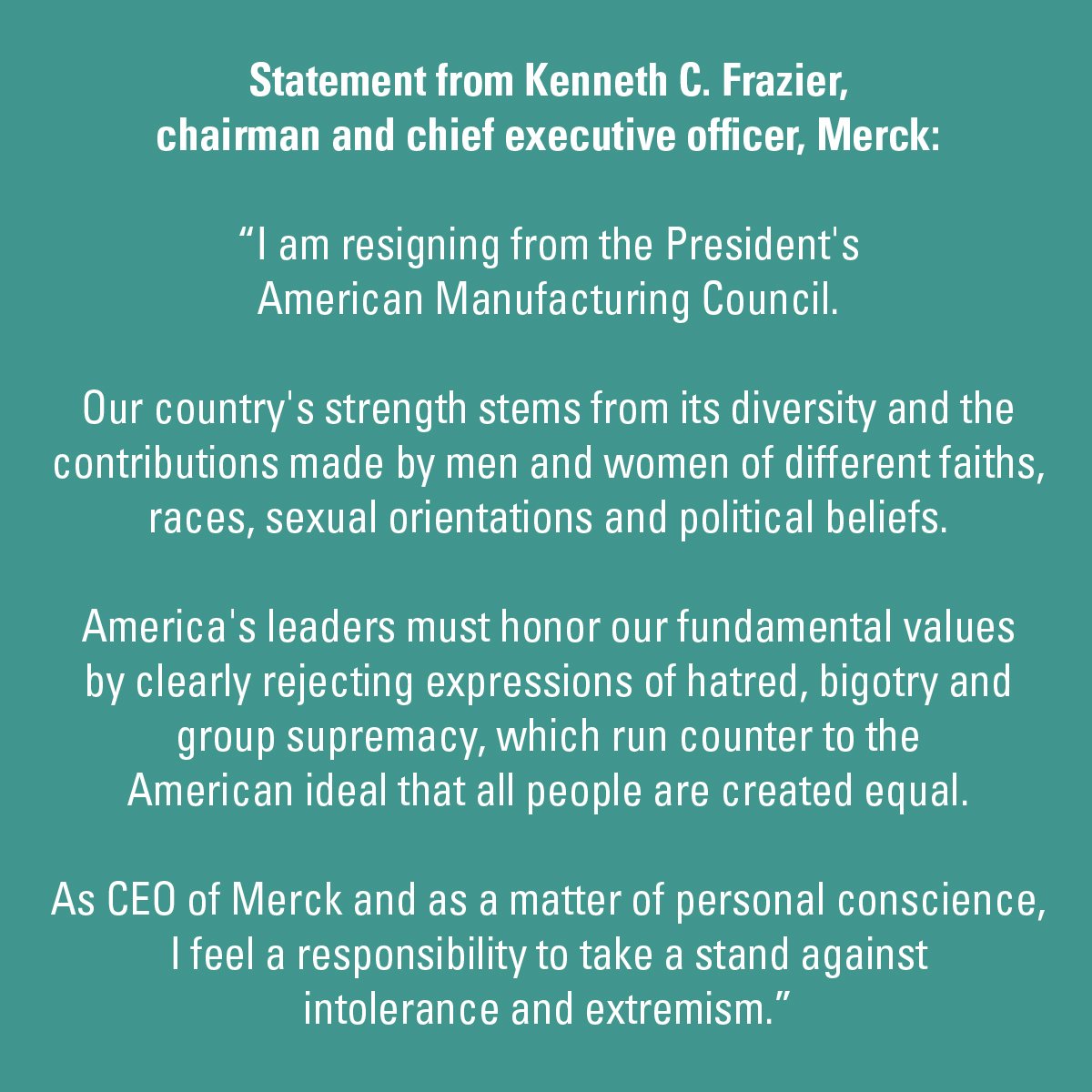

In one of the handful of direct stock investments Stein

holds, she listed between $50,001 and $100,000 in the pharmaceutical giant

Merck, which paid a record fine for overbilling Medicaid. She has also invested

$1,130,010 to $2,400,000 in funds that maintain significant stakes in Pfizer,

Novartis, Johnson & Johnson, and Allergan.

…

Stein has between $500,004 to $1,100,000 invested in funds

that maintain significant stakes in Phillip Morris International, the tobacco

giant that manufactures Marlboro cigarettes and 17 other tobacco brands.

…

(S)he has between $50,001-$100,000 invested in a fund that

has Raytheon Corp. as its fourth largest holding, a $38 million investment.

Raytheon, which is the fourth largest defense contractor in the world and

derives 90 percent of its revenue from military contracts, manufactures drone

systems, which Stein has committed to ending, and significant missile systems.

And for the height of dis-ingenuousness.

Stein said that she has “explored” more socially responsible

funds but “found their investments in fracking and large-scale biofuels not

much better than the non-green funds. I have not yet found the mutual funds

that represent my goals of advancing the cause of people, planet, and peace.”

It took me less than 30 seconds with a web search to find funds that don't invest in fracking.

Many critics say clean-energy and socially responsible

investment funds offer a poor rate of return and should generally be avoided… Which likely explains why Stein chose

to invest her wealth in funds that have often offered double-digit returns.

(I)t was his wife's money and it was made by

investing in some pretty damaging and unconscious companies (Monsanto,

McDonald's, tobacco and oil companies and several hedge funds to name but a

few.)

That was about Aaron Woolf, his Democratic opponent in 2014. I suspect he's referring to Woolf's wife owning mutual funds that invested in those companies and industries and that she's not directly invested in them. I can hardly wait to be in a comment thread involving or including MF and linking to this Stein story. C'mon 2018.